Economic Trouble in the Age of Coronavirus

“Business society has been an amazing club for me and my peers. I joined it during sophomore year because I had a fascination with business and our economy. Now as a co-president of the club I am able to give back and teach what I have learned to the members,” said Vice President Anuj Phophaliya. The club was not able to discuss the Coronavirus pandemic’s impact upon the American economy, since in-person schooling stopped after March 16th, 2020.

Quarantine has had a distinct and undeniable impact on our daily lives. While it is necessary for public health, there is unquestionable damage being done. One of the potentially largest threats is in the harm posed to Wall Street and the economy at large.

When the stock market crashed in February 2020, after COVID-19 began to hit the states, there was a point at which stock values fell quicker than the fall of the 2008 housing crisis While stock values are not inherently indicative of how the economy will fare, it was not a good omen by any means.

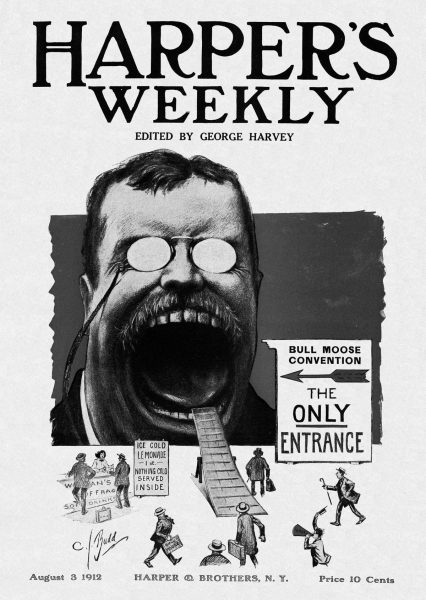

The closest economic crisis compared to our current one is the aforementioned 2008 housing crisis. Reaching its height in October of that year, the 2008 housing crisis’ main impact was that property values crashed. In October of 2008 alone, some 85,000 people lost their homes to foreclosure, increasing the amount of houses on the markets, worsening the situation. The following month, in November, house sales fell 8.6%, and even low interest rates on mortgages did little to alleviate the situation, refinancing existing mortgages, and not helping people attempting to buy their first houses.

Although the conditions during the 2008 housing crisis made it close to impossible to envision a stronger economic future, the economy eventually pulled itself out. Even while the recession caused by COVID-19 did not continue in such a dire direction, that does not mean there were no impacts, nor that it receded by itself.

To deal with the current recession, the Federal Reserve Bank of New York offered a number of short term bank loans in March 2020. The distribution method for this is as follows; $500 billion on March 12, 2020; $1 trillion split into two packages the next day, and another $500 billion each week for the rest of the month. Thankfully, these were loans, and the government did not just decide to throw a total of $1.5 trillion, and then $500 billion weekly, into banks as opposed to, say the hospitals that would, and have been, dealing with the COVID-19 crisis.

As stated earlier however, stocks and banks are not indicative of the economy as a whole, but that is not to say that other aspects of the economy have fared any better. In the “great recession” that both caused and was left in the wake of the housing crisis of 2008, unemployment reached a height of 10% in October 2009. This past April 2020, unemployment reached 14.7%, with May’s values expected to be at 20%, and given the pool of millions of people, even a one percent uptick is devastating, let alone ten percent.

Though I wish I could reassure those who are worried about the future of this recession and say that we are on the tail end of it, economists are split on the issue of the recession. The International Monetary Fund (IMF) warns that the “coronavirus recession” will be the most severe global economic downturn since the Great Depression, and that the great recession will not be comparable to it. Mark Zandi, among other economists, on the other hand, believe that the recession will have already concluded in May 2020, and that this June we will see growth. Furthermore, he believes that we have grown back what was immediately lost initially, but whether this will end the recession, at least for the time being, no one can tell.

Though I wish I could reassure those who are worried about the future of this recession and say that we are on the tail end of it, economists are split on the issue of the recession.

Scott Ernsberger is a Managing Editor/Advisory Editor for ‘The Science Survey.' As a Managing Editor, Scott helps with copy-editing and keeping deadlines,...

Nate Lentz is a Photo Editor and Chief Photographer for ‘The Observatory.’ Nate has always had a great appreciation for the world around him, and uses...