A Narrow Escape for Students with GOP Tax Plan

Jonathan Rodriguez ’18 and Alysa Chen ’19, Editorial Columnists.

Following protests by students and complaints by congresspeople from both parties, the final version of the Republican tax bill came into effect on December 19, 2017, when the Senate narrowly voted for it 51-48. Bronx Science students, especially those with plans to attend graduate school, may take a breath of relief in knowing that large, unpopular education-related proposals from earlier drafts of the bill have been rejected.

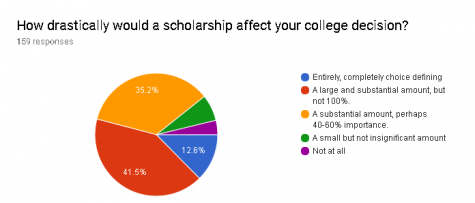

A recent poll of the Bronx Science upperclassmen showed that 12% of students believe that a scholarship entirely defines their choice of college, with another 40% stating it is a large and substantial part of their choice. For these students, the originally proposed GOP tax plan could have had a devastating impact on their futures in academia. Fortunately, these negative effects won’t be occurring in the near future.

“This bill is not about your welfare as a student.”

In brief, the GOP tax plan introduced in mid-November would have slashed corporate taxes by $1.5 trillion and eliminated several tax breaks. In this earlier version of the bill, students, in particular, would have paid for many of these tax cuts, slated to face harsh tax surges. For example, one of the initial provisions would have eliminated student loan interest deductions. These deductions currently allow students with eligible income to scrape off $2,500 from their amount of owed interest.

Ending these deductions would have resulted in a huge loss for students; according to the IRS—or Internal Revenue Service, a branch of the U.S. Department of Treasury — the student loan interest deduction 40 million Americans currently remain in student debt.

“The government is neglecting the future of the country to ‘compensate’ for the astronomical decrease in tax revenue that tax cuts to the upper class will get,” Sebastian Baez ’19 commented. Baez raised an important point that reinforced the controversy of the tax bill provisions: why should students be responsible for tax cuts on the upper class?

Additionally, another proposal from the original tax bill would have taxed tuition waivers as income. This meant that students would have had to pay taxes on so-called income they were not receiving. This primarily targeted graduate students who receive tuition discounts, mainly those who work as teachers or research assistants or are working towards a doctorate degree. For a graduate student with a $40,000 tuition break, that would more than triple their typical taxable income, making some graduate degrees not financially viable at all, and thus affecting the participation at research programs in many universities.

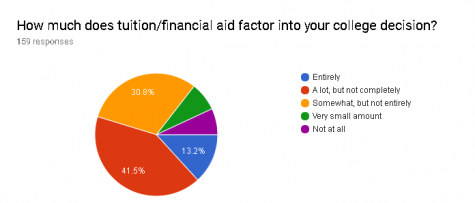

A recent poll taken by Bronx Science students at the request of The Science Survey.

“This bill is not about your welfare as a student,” Dr. Todd Davis, a history teacher, commented. Reflecting on his experience as a graduate student, he said, “I would be obliged to pay taxes on a bunch of money that would not have been mine. It would have resulted in poverty, and I would not have been able to go to school, nor would most.”

In response to those proposals, student protests of higher education swept the country to prevent the bill from being passed. Eight students were arrested during a Capitol Hill demonstration, and many other rallies and walkouts occurred under organized efforts of graduate students. Through protest and debate, this controversy eventually propelled the Republican House to rescind the interest deduction and taxable income provisions from the tax bill.

Many families could have also been impacted by changes to the American Opportunity Tax Credit and Lifetime Learning Credit that ultimately failed to pass through Senate. Under the final plan, which preserves the current American Opportunity Tax Credit, eligible families receive $2,500 in tax credit annually for every child enrolled in college, usable for four years of a child’s education. The plan also preserves the Lifetime Learning Credit, which bestows up to $2,000 per year for eligible families, usable for every year they use in higher education.

In the earlier drafts of the tax bill, however, the Lifetime Learning Credit would have been eliminated, and the American Opportunity Tax Credit would have been expanded to a fifth year at a reduced benefit. Therefore, current and future eligible students pursuing higher education past their first four years of college would have essentially lost these valuable benefits, which would have made the entire process more financially difficult for graduate students.

Bronx Science boasts a 98.3% graduation rate, with most students immediately enrolling into top colleges having received scholarships or merit-based financial aid. With college costs growing by the year, students are often dependent upon those scholarships to attend the prestigious schools into which they are accepted.

With around 715 seniors graduating each year from Bronx Science, embarking on their journey into higher education, the fight for equal, accessible education remains relevant to all current and prospective graduates of our storied public high school.

Alysa Chen is an Editor-in-Chief for ‘The Science Survey’ and an Academics Section Reporter for ‘The Observatory.’ She enjoys journalistic writing...

Jonathan Rodriguez is the People Section Editor for ‘The Observatory,’ and a Staff Reporter for ‘The Science Survey.’ Jonathan is an avid fan of...

Miles Conn is the Chief Photo Editor and and a Photographer for both the ‘The Science Survey’ and ‘The Observatory.’ Miles has always had an interest...