Virtual Gains and Losses: A Stock Market Competition in Bronx Science’s Financial Actuarial Mathematics Class

At Bronx Science, the FAM (Financial Actuarial Mathematics) class of Bronx Science participated in a virtual stock market competition on MarketWatch for their midterm project, creating a fun and interactive project for students.

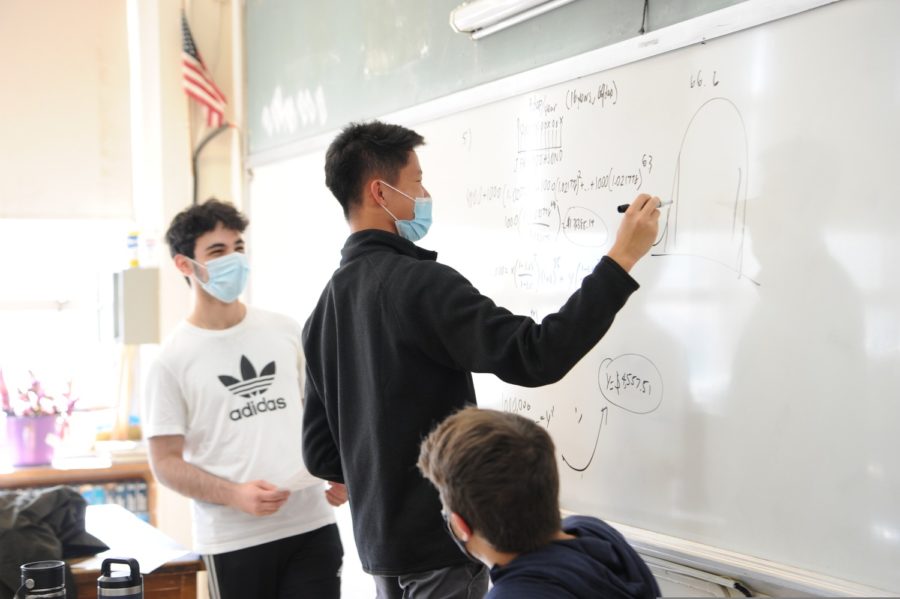

Pictured left to right are Raffi Chirinian ‘22, James Zhou ‘22, and Mr. Garritano. Students work together to solve a question on annuities.

Managing money is something that is easily overlooked in its importance to our daily lives. When it comes to understanding how to properly manage and invest in money, trouble arises for those with limited knowledge. At Bronx Science, the Financial Actuarial Mathematics (FAM) class applies the concept of finance into mathematics and students learn all about finance, including stocks. Mr. Garritano, the teacher of the FAM class, hosted a stock market competition on MarketWatch for their midterm project. He hoped to have the students experience the stock market, all in a risk-free manner. As a fun and interactive project for the students, Mr. Garritano said that he intended to let the stock market “experts show their skills” and also have the “newbies get their first experience with the market.”

So, what is the stock market?

The stock market is the aggregation of stocks, or shares, held by companies that are bought and sold by individuals, with the common goal of investing in certain companies that seem profitable in the long run. This earns investors net profit. Despite being a seemingly attractive system in which to earn money, the stock market is often avoided by many because of its uncertainty and the risk involved to make money, making the system essentially slightly akin to gambling. Mr. Garritano understands this sentiment and has incorporated this project into the curriculum in order to help students experience the system first-hand.

The project is centered around MarketWatch, a simple website that allows individuals to learn about the latest news regarding the stock market and all finance-related substances. With a custom simulated stock market game built into it, Mr. Garritano created the stock market competition for all of his FAM classes to allow the students to experience investing in the market.

The stock market is often unpredictable, as such, there is no correct method in trading stocks. There is also no easy way to make money, since many individuals will often lose great amounts of money in a very short period of time. Mr. Garritano believes in the Warren Buffet strategy, which involves buying companies at cheap prices and then holding them for a long period of time, essentially predicting that the company will significantly increase in value over a long-term future. “Consistently trading in and out of positions is a quick way to lose money,” said Mr. Garritano. As a student in the FAM class, I have personally experienced this. I am currently sitting around -45% of my overall imaginary returns, meaning that I have lost around 45% of my original total net worth of an imaginary $10,000, and surprisingly enough, that overall imaginary return is not the last-place ranking in my class.

On the contrary, Raffi Chirinian ‘22 has been especially successful despite buying and selling very quickly with his imaginary stocks. He started the competition through some shorts, a trading method where the investor believes that the stock will fall in value and thus profit from the short position, and “150 trades on very volatile stock.” These techniques managed to secure him with enough money to trade for imaginary stable stocks in the long term. Chirinian did not take entirely uncalculated risks, however,; he made sure that his imaginary stocks “displayed clear trends in their rises and falls.”

Aryan Arora ‘22 takes a different approach to the stock market and often looks at the news to inform himself about any stocks on the rise. “I also trade based on support and resistance paired with volume,” said Arora ‘22, which is similar to analyzing trends in the stock. In the case of imaginary shorting stocks, Arora has had “bad experiences with shorting” and will “almost never short.”

There are a lot of different approaches for students to take in the competition using imaginary stocks, and there is nothing to fret about even if you lose a ton of money in the end, since the speculation is imaginary and does not involve real money. Considering that most of the class ended up receiving negative total returns, it is clear that investing in the stock market for the short run won’t always promise a profit. It is a fun competition for students interested in exploring and engaging in the stock market, and Mr. Garritano notes that the competition is here to stay for all students interested in the vast financial world. “I’ll definitely make some adjustments, but the competition is here to stay. If you’re reading this article, consider joining AP Stats and FAM next year!”

“I’ll definitely make some adjustments, but the competition is here to stay. If you’re reading this article, consider joining AP Stats and FAM next year!” said Mr. Garritano, a Bronx Scienc teacher of the Financial Actuarial Mathematics (FAM) class.

Jason Dai is a Staff Reporter for ‘The Science Survey.’ He finds journalism to be valuable because of its importance in providing information to the...

Acadia Bost is a returning Editor-in-Chief for ‘The Science Survey.’ Placing an emphasis in their writing on the more structural, long term problems...