The I.R.S. Is Outmatched

How far would you go to sweep your dues under the rug?

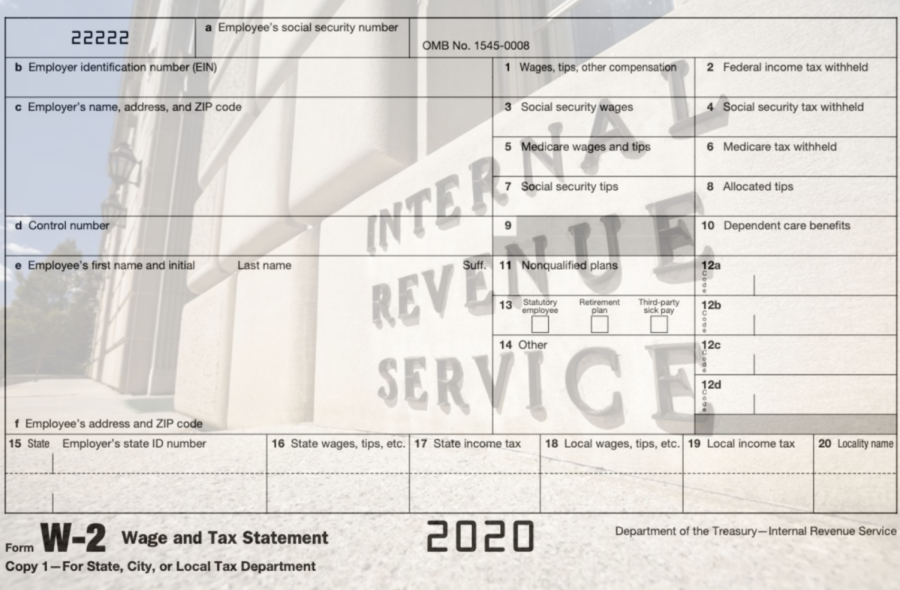

The IRS requires all employers engaged in business or trade, who pay remuneration, to file a Form W-2 for each employee in order to report individual wage and salary information. The W-2 also reports federal, state, and other taxes that are withheld from paychecks. This information is crucial when preparing accurate tax returns.

The year that he won the presidency in 2016, Donald J. Trump paid a mere $750 in federal income taxes. In stark contrast, the average American pays approximately $2,392 in federal income taxes each year. The great disparity between the amount of taxes incurred in the most common income brackets and that of the wealthy is nothing new. In fact, it is a product of the laws passed by politicians voted into office by their constituents — U.S. citizens.

Trump’s tax returns illustrate the profound inequities of the tax code and the difficulties encountered by the Federal government to rectify such disparities. Our enforcement system responsible for resolving these issues, the Internal Revenue Service (IRS), is underfunded and outgunned. Without sufficient resources to aggressively monitor compliance, hundreds of billions of tax dollars will continue to slip through its grasp annually.

In the past 20 years, Congress has slashed funding for the IRS, causing the federal agency to lose ground in the system that millions of Americans rely upon. Since 2010, the number of IRS auditors has fallen sharply, and the agency’s funding has plummeted in excess of 20% in real (inflation-adjusted) dollars from $14.3 billion in 2010 to $11.4 billion in 2018. With the exception of 2016, funding has dropped below the prior year’s total during this timeframe. Headcount reductions, or layoffs, surpassed 22%, plunging from 94,700 to 73,600. These eliminations included employees that handled collection cases and the most complicated audits.

In 2018, the IRS collected $3.5 trillion in taxes, which was almost 95% of total federal revenues. In order to collect these taxes, the federal government expects taxpayers to report their income at the conclusion of the tax year. Employers issue wage statement (W-2) forms to their employees which indicate the amount earned during the year, as well as the various taxes deducted from paychecks. The IRS depends on taxpayers to calculate their various sources of earnings, income, and offsets to various degrees, and if applicable, their deductions allowable under the tax code.

IRS agents will try to reconcile figures that taxpayers report on their tax returns with numbers supplied by the sources of the individual’s income and expenses to determine if the calculations are appropriate. However, our system has significant deficiencies as some taxpayers fail to pay hundreds of billions of dollars in taxes.

Elected officials have often discussed a desire to plug the holes and eliminate lost revenues through changes in IRS funding, as well as to implement tougher enforcement for those who maximize their tax avoidance. “Wealthy elite earn their money in a different way than most of us do. Many of the elite earn their money by lending money, buying and selling bonds, owning shares of companies, and trading currency. These methods are taxed differently than income from a standard job would be,” said Dhiman Shahid ’21.

With less funding and lower headcounts to enforce the IRS’s tax code, however, the IRS is defenseless. With the ballooning of the federal deficits due to the pandemic, a stronger IRS could provide an increase in the amount of taxes collected. Our income tax system is supposed to apply the same progressive tax rate to the entirety of a person’s earnings annually. In reality, this is not the probable case due to tax expenditures. Some call these expenditures “loopholes,” which give them a sinister tone, but in reality, they are government-sanctioned. They are expenditures as it is government spending via tax rules. These loopholes benefit households across most income levels.

The loopholes significantly pared government revenues in excess of $1.3 trillion in 2018. “With the consistent use of tax loopholes, such as donations, it is pretty clear that loopholes were intended to exist and probably will continue to exist in the near future,” said Shahid.

The IRS also estimates that it lost approximately $441 billion annually between 2011 and 2013. These losses are the difference between the amount of taxes owed by corporations and citizens compared to the sums actually collected annually — the tax gap. The net tax gap was an estimated $381 billion annually over that period. Moreover, enforcement activities by the IRS discourage taxpayers from making misstatements on their returns.

With Trump’s $750 federal income tax case, the ultra wealthy, and large corporations, it comes down to the fact that all of the tax avoidance moves are generally legal. The closure of loopholes that allow taxpayers to reduce their tax liabilities is a crucial first step towards readjusting our system. The crackdown of illegal evasion and avoidance is a pressing order, which can happen by investing more into the IRS for them to go up against the army of accountants employed by the wealthy elites. Taxes are what we pay to maintain the services in our country, and we must invest in taxpayer compliance.

“With the consistent use of tax loopholes, such as donations, it is pretty clear that loopholes were intended to exist and probably will continue to exist within the IRS in the near future,” said Dhiman Shahid ’21.

Karen Phua is a Copy Chief Editor for ‘The Science Survey.’ She enjoys journalistic writing for the connection that it provides with avid readers interested...