The Fall of a Petrostate: How America Exacerbated a Humanitarian Crisis

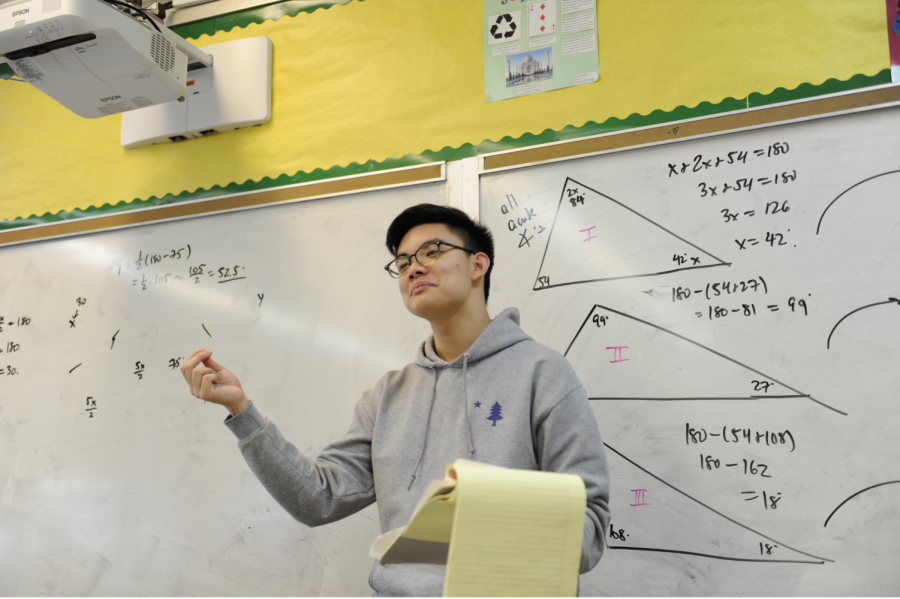

Congressional Debate Novice Director Garreth Hui ’20 presents a speech in practice about Venezuela’s economy. “It is so hard to imagine how one of the world’s wealthiest, most natural resource rich economies can have such extreme poverty,” said Hui.

On the eve of Hugo Chávez’s death in 2013, Venezuela was plagued by a mountain of uncertainty. Chávez had been Venezuela’s leader for almost a generation; most of those fighting in Venezuela’s army had not served under any other Commander in Chief, and its citizens coming of age had not been ruled by any other leader. As millions took to the street to mourn Chávez’s passing, one question was on the tip of their collective tongue: “What comes next?”

The answer to that question is Nicholás Maduro Moros, commonly known in Venezuela as “Maduro.” Maduro, too, had been a shepherd of the Chávez era in Venezuela, working himself up from bus driver, to trade unionist, and, ultimately, to the Vice President of the nation that he held dear. Maduro’s position of power had made sense to many Venezuelans; he was a vanguard of the Socialist Party that had delivered generous social spending to the poor for decades. Chávez had even ensured that Maduro would legally succeed him after his death. However, when Maduro took office in 2013, winning a contested special election by a narrow margin, it became clear that an entirely new problem was afoot as two crises, one political and the other economic, took hold in Venezuela.

The political “crisis” was less a crisis so as much as a takeover. Hugo Chávez had ruled Venezuela with vast personal power, consolidating authority and sharing the state’s wealth with the military and his inner circle. However, when Maduro took office, he began to show his iron fist. By 2015, Maduro began to “rule by decree,” no longer needing legislative approval for most of his initiatives. He used his loyalists within the Supreme Tribunal to erode the power of the National Assembly such that it could no longer check his growing power and rig any elections that would potentially put his ruling status in jeopardy. Soon, Venezuela began appearing on the list of “authoritarian regimes” worldwide, as the country swiftly became classified as a dictatorship rather than simply an illiberal democracy, with opposition leaders jailed and protests violently suppressed. Whereas Chávez ruled through co-opting his people with handouts, Maduro intended to coerce them into compliance.

The second crisis, the one Maduro had considerably less control over, was the economic collapse that pushed Venezuela from being one of Latin America’s wealthiest countries to one of the world’s very poorest. Venezuela had long been a petrostate, as it has the largest oil reserves in the entire world, and attains more than 90 percent of its export revenue from oil alone. As such, fluctuations in the price of oil are crucial in controlling Venezuela’s destiny; when oil profits were robust, its welfare state expanded and Venezuelans shared in its prosperity. When oil revenue collapsed, so did the ability of the government to import basic necessities like food and medicine. Venezuela was, after all, a socialist state, with more than three-quarters of its Gross Domestic Product in state-run sectors, meaning that a fall in the oil revenue that funded nearly all government operations affected not just one industry but the entire economy.

In 2014, less than a year into Nicholás Maduro’s first term, the crisis that economists had warned petrostates about finally materialized. Oil prices shot down and, all of a sudden, Venezuela could no longer afford food and medicine imports as its currency reserves collapsed. Shortages of basic necessities became widespread, which were only exacerbated by socialist policy like price and currency controls that constrained the private sector. Maduro’s handling of the crisis made it much worse, as he tried to print his way out of destitution, increasing the supply of the Venezuelan bolivar, adding and slashing zeros to the currency, and raising the minimum wage again and again, as hyperinflation of over three million percent took hold in Venezuela. The money Venezuelans had saved for decades became more and more worthless each day and more than ninety percent of the population fell into poverty with millions malnourished and more than a third of children developmentally stunted.

To many, this narrative seems to preclude the possibility that the United States was the agent of destruction in Venezuela. After all, it was the fall in oil prices that destroyed its economy, the incompetence of its Chief Executive that contributed to its hyperinflation, and the structure of its oil-reliant economy that made it vulnerable to the resource curse. While none of this is untrue, American policy did play a crucial role in preventing Venezuela from recovering from this economic crisis. Oil prices began to rise again in 2016, providing hope that Venezuela’s revenue could recover and better living standards could be restored. Venezuela’s state-run oil company was able to produce more than three million barrels of oil per day that year, which began to be sold again at higher prices. However, just as Venezuela might have been on a track toward recovery, the United States decided that it had the panacea to Venezuela’s political problems: economic sanctions.

The U.S. had long seen Maduro as both unfriendly to its and the Venezuelan people’s interests, and sanctions on top Venezuelan officials began under the Obama administration. However, as long as Venezuela’s oil company brought in robust revenue, these targeted sanctions mattered little, because the government survived through its oil wealth. The Trump Administration moved to capitalize on its oil-dependence, seeking to bring down Maduro’s regime by freezing Venezuelan assets and imposing an embargo on oil purchases, cutting Venezuela off from selling its oil to its largest trading partner. The result was a dramatic fall in oil revenue just as the oil sector may have been beginning to recover, as Venezuela’s oil production declined five times faster than it had been projected to and three times faster than in all of Venezuelan history. All of a sudden, Venezuela was cut off from global oil markets and so it could no longer attain the revenue necessary to spend on its people. The World Health Organization found that after sanctions, food and medicine imports plummeted even faster, with malnourishment quadrupling and medicine shortages putting 300,000 vulnerable Venezuelans at risk.

Despite all this suffering, the regime change that the United States imagined never came to fruition. Ultimately, American policymakers discovered that the military, the key agent of regime change in an authoritarian system like Venezuela’s, was far more loyal to Maduro than they had anticipated, as Maduro gave military leaders more favorable exchange rates, amnesty for corruption, and put them in charge of profitable industries like illicit gold mining and drug trafficking. Coup attempts were tried and failed at the beginning of 2019, and it became clear that Maduro’s grip on power was firm. “Sanctions had their intended effect of wreaking havoc on Venezuela’s economy but they did not take its autocrat out of power,” said Garreth Hui ’20.

The only upside in this chaos has been that the continued collapse of Venezuela’s state-run economy has led to a push toward privatization and liberalization. By the end of 2019, price controls that prevented profitable food sales were lifted and currency controls that forbade transactions in the U.S. Dollar were also scrapped, allowing for de-facto dollarization. The result has been a flourishing of private sector activity as The Economist reports that inflation has gone down by around 96 percent, and 70 percent of Venezuelans now have regular access to the dollar through remittances, with the majority of transactions now taking place in the dollar rather than the, now worthless, bolivar.

“These reforms have not solved the structural issues in Venezuela’s economy as the state still relies on oil revenue which sanctions have undercut,” said Aerin Mann ’21. Indeed, even with some optimism returning in Venezuela, the IMF still projects that its GDP will decline by an additional 20 percent in the coming year, less than the 35 percent decline Venezuela experienced last year, but a far cry from a sustainable recovery effort. As such, the United States must take the one action which could actually restore economic activity and confidence to Venezuela’s broken markets: lifting the sanctions that have harmed its people while allowing its leaders to keep their choke-hold on power.

“Sanctions had their intended effect of wreaking havoc on Venezuela’s economy but they did not take its autocrat out of power,” said Garreth Hui ’20.

Benjamin Oestericher is a Senior Staff Reporter for ‘The Science Survey’ and an Editor-in-Chief for ‘The Observatory.’ This is his secord year...

Samama Moontaha is an Editor-in-Chief for ‘The Science Survey.’ She loves writing journalistic stories about the students at Bronx Science, bringing...